Why choose Enel Energia for your large company

The energy of a strategic partner

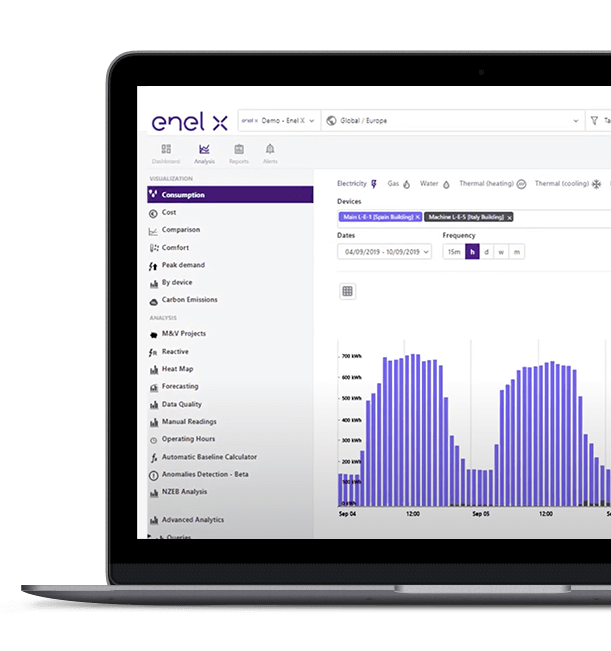

Choosing our services means relying on a solid and expert partner capable of responding to the needs of your business in a sustainable and effective way. Choosing us means having access to advanced monitoring technologies that help to reduce inefficiencies for more effective energy management.

You have at your disposal a network of expert consultants throughout the national territory ready to identify with you our best offers to grow your business.

Embrace new solutions for your business

We give shape to sustainability

We choose to adopt a sustainable approach that positively influences relationships with the community and the territory, laying the foundations for building an aware clientele and triggering a virtuous circuit of mutual trust and collaboration. The transition towards responsible consumption, supported by a reliable energy supply, becomes the key to consolidating our position as a company committed to promoting positive change for 'environment and for society.

Choose sustainable energy for your company

By choosing our offers powered by energy from renewable sources and certified by the "guarantee of origin" system of the Energy Services manager (EC directive 2009/28/EC), you can make your business more sustainable and enhance your business by making it recognizable thanks to the Green Kit and solutions for corporate energy efficiency.